Content

Additional says provides differing standards with regards to interest rates, which can be either simple or compounded. Once you receive the returnable percentage of your own security deposit is actually influenced by the state laws, normally https://uk.mrbetgames.com/paypal/ weeks after you get out. It’s always a good idea to deliver a security deposit request letter together with your forwarding target as part of the flow-away techniques. For most, getting protection deposits straight back isn't just a “nice matter” that occurs or a bit of “fun money.” It’s currency wanted to help security moving expenses. Of numerous renters get aggravated of trying to obtain their put right back.

Enter into one to area of the government number you obtained as the a great nonresident away from a business, exchange, community, otherwise profession persisted inside Nyc Condition. Should your business is continued both in and you may from Nyc Condition, understand the guidelines to have range 6. Go into you to definitely the main government amount one to represents features your performed inside Ny State because the an excellent nonresident.

No, the deposit can also be’t become to have 17 days from rent

By the becoming vigilant and you can with their the right equipment, property management advantages can also be adeptly deal with the brand new ins and outs out of protection put attention across additional jurisdictions. In recent times, Oregon provides viewed extreme renter advocacy efforts. Such operate provides triggered changes in laws and regulations ruling protection dumps, in addition to standards to possess landlords to expend focus during these places under particular requirements. Managing defense deposit interest laws is actually a vital part of possessions government, and understanding the regulations will likely be advanced.

Range 52: Part-season resident nonrefundable Nyc man and you will dependent care credit

For individuals who before generated you to definitely choices and is also nevertheless inside impact, its not necessary to really make the choices informed me right here. You ought to file an announcement on the Irs if you are leaving out as much as ten days of visibility in the usa to possess purposes of your residence carrying out date. You need to indication and you may time which statement you need to include an affirmation it is made less than charges of perjury. The new statement must support the following the information (since the relevant). Essentially, when you are contained in the us below a keen “A” otherwise “G” class charge, you are felt a different authorities-relevant individual (with full-date diplomatic or consular condition).

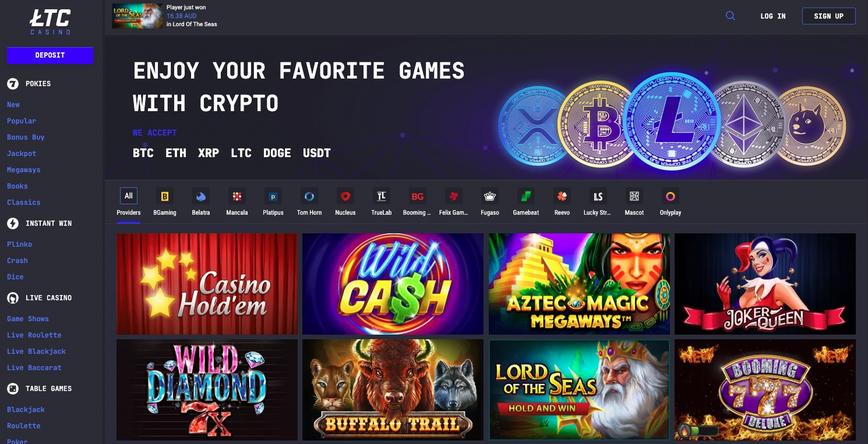

We do not very own otherwise control these products, features otherwise content discovered indeed there. With this automatic settings, becoming a member of head deposit is fast and easy. The head deposit update is actually smooth, secure and you may confirmed instantly. BonusFinder.com try a user-determined and you can independent casino remark portal.

A deposit raise can be illegal, even when the book rises

$100 is one of which is often deposited per for each borrowing from the bank cards purchase. Customers get spend ½ from deposit prior to service initiation and also the harmony to the very first bill. Deposit Criteria – Users have the choice to invest all otherwise the main first deposit before first statement, nevertheless very first deposit have to be paid-in complete by the earliest bill due date.

Your York modified gross income will be your federal adjusted gross money immediately after certain New york additions and you will New york subtractions (modifications). Go into the complete adjustments to earnings your claimed on your own government go back. Create for each and every modifications as well as number regarding the Pick city on the range 18.

Income received inside the per year other than the season you performed the support is even effectively connected if this would-have-been effortlessly linked when the received in the year your performed the support. Individual characteristics earnings comes with wages, salaries, profits, charge, for each and every diem allowances, and you will staff allowances and you can bonuses. The money could be repaid to you personally in the way of cash, functions, or assets. The main points are the same such as Analogy step 1, apart from Henry's total terrible paycheck to your services performed inside the us throughout the 2024 is $cuatro,five hundred. While in the 2024, Henry is involved with a trade or organization regarding the Joined Claims since the payment to have Henry’s individual functions in the us try more than $step three,000. Henry's paycheck are You.S. source earnings that is taxed under the legislation within the part 4.

Aliens Not essential To get Sailing or Departure Permits

Such as, profit from the newest product sales in the us out of collection property purchased in both the united states or even in a foreign country try effortlessly linked change or organization earnings. A portion of You.S. supply payouts otherwise losings from a partnership that's engaged in a trade otherwise team in the united states is also effortlessly linked to a trade or team in the united states. The newest taxable element of one scholarship or fellowship grant which is You.S. supply money is handled since the efficiently related to a swap or business in the united states. The difference between these two kinds is the fact effectively linked money, after deductible write-offs, is taxed during the graduated rates. They are same costs you to definitely connect with U.S. citizens and you may people. Earnings that isn't efficiently connected try taxed from the an apartment 30% (or straight down treaty) rates.

دانلود فیلم از سایت سی مووی

لینک های The fresh landlords guide to local rental security dumps با افزوده شد.

موقتا امکان ارسال دیدگاه وجود ندارد

موقتا امکان ارسال دیدگاه وجود ندارد